Transition Matrix

Transition rate:

A transition rate represents the frequency at which credit ratings are upgraded, downgraded, or remain unchanged over a specified period. It can be calculated across the entire population of rated entities or focused on a specific rating category to assess rating stability or credit migration trends.

Transition Study:

A rating transition study examines how credit ratings evolve over time, providing insights into rating stability and migration patterns. This analysis is a key component of NCR’s evaluation process, helping to assess the consistency and predictive performance of its credit ratings.

Methodology:

NCR employs a rigorous and transparent methodology to analyze rating transitions, which helps assess the stability and performance of its credit ratings over time. The key steps in the process are outlined below:

- Issuers are grouped into static pools, also known as cohorts, based on the year in which their ratings were active and outstanding at the beginning of that year.

- The study monitors long-term ratings that have been assigned and accepted by issuers on an annual basis, capturing changes such as upgrades, downgrades, or reaffirmations.

- The analysis is conducted at the issuer level, not at the instrument level. Each issuer is counted only once to avoid duplication and distortion in the results.

- The transition study covers issuers across all major sectors, including Banks, Financial Institutions, and Corporates.

- Separate cohorts are created for each financial year. Each cohort includes all ratings outstanding at the beginning of the year and tracks rating movements over the following 12-month period.

- Data from all annual cohorts are consolidated to develop a weighted average transition matrix, providing a comprehensive view of rating migration trends.

- For accurate computation, only issuers with active ratings at both the start and end of the observation period are included. Issuers whose ratings were withdrawn or suspended during the period are excluded from the respective opening cohort.

Transition Matrix:

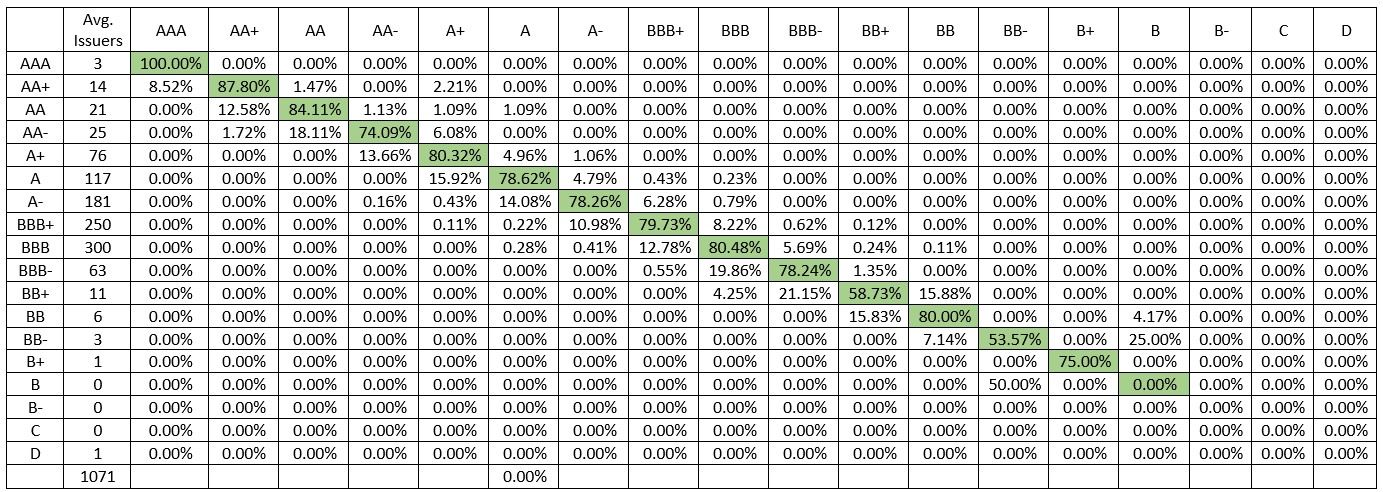

Corporate:

NCR has conducted transition matrix analysis of the rated corporate clients from the year 2018 to year 2023. Transition matrix analysis is done to see the percentage of changes in credit rating of each rating category.

One Year’s Weighted Average Rating Transition Rates from the Year 2018 to Year 2023

Rating transition study looks at how ratings have changed over a period of time. Based on NCR’s weighted average one-year transition matrix, it can be inferred that out of all the ‘A’ rated companies at the beginning of the year 78.62% remained in the same category, 15.92% have been upgraded to ‘A+’ and 4.97% have been downgraded to ‘A-’ category. Similar inferences can be drawn for the other rating categories as well.

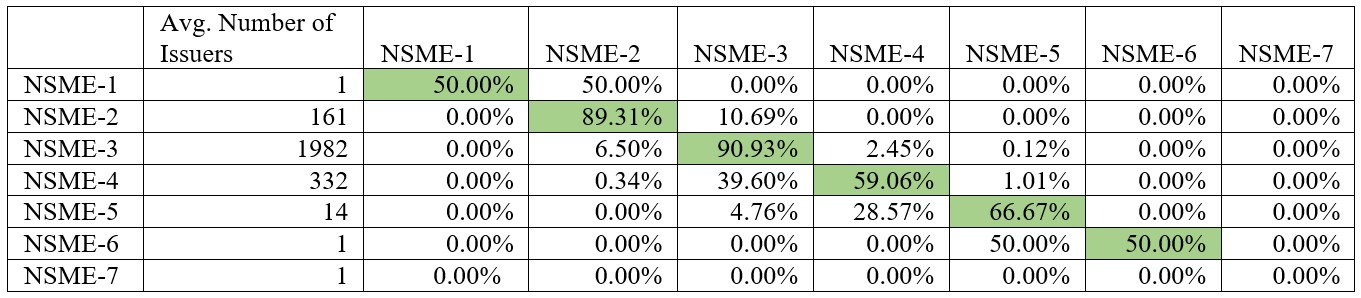

SME:

NCR has also conducted transition matrix analysis of the rated SME clients from the year 2018 to year 2023. Transition matrix analysis is done to see the percentage of changes in credit rating of each rating category.

One Year’s Weighted Average Rating Transition Rates from the Year 2018 to Year 2023

Rating transition study looks at how ratings have changed over a period of time. Based on NCR’s weighted average one-year transition matrix, it can be inferred that out of all the ‘NSME-3’ rated companies at the beginning of the year 90.93% remained in the same category, 6.50% have been upgraded to ‘NSME-2’ and 2.45% have been downgraded to ‘NSME-4’ category. Similar inferences can be drawn for the other rating categories as well.

|

Disclaimer: The Methodology is developed by National Credit Ratings Limited (NCRL) based on data/information from secondary reliable sources which is in compliance with the guidelines provided by Bangladesh Securities and Exchange Commission and Bangladesh Bank. NCRL puts best efforts to prepare this document. The methodology may inherit human error, technical and/or systematic error as its limitation. Therefore, NCRL does not provide warranty of any kind for this document. This is the property of NCRL and is only used for rating of corporate issues. None of the information in this document can be copied or otherwise reproduced, stored or disseminated in whole or in part in any form or by any means whatsoever by any person without written consent of NCRL. |

For further details please contact:

National Credit Ratings Ltd.

Zaman Tower (8th Floor)

37/2, Box Culvert Road, Purana Paltan

Dhaka-1000

Tel: +88-02-47120156-58

e-mail: ncrlbd10@yahoo.com, info@ncrbd.com

website: www.ncrbd.com