Default Study

Default Rate:

Default rate refers to the proportion of rated entities (such as corporations or financial instruments) that default within a specified time period, typically expressed as a percentage. It is calculated by dividing the number of defaults during the period by the number of entities that held the rating throughout the period. Default rates can be measured across different rating categories (e.g., AAA to BB) and over various time horizons.

Methodology:

NCR adopts the cohort (static pool) approach to evaluate the default performance of its rated entities across various rating categories. Under this method, cohorts are formed based on all issuers with active long-term ratings at the beginning of each calendar year within the study period. The analysis is conducted at the issuer level, not at the instrument level, with each issuer’s entity rating considered for the assessment.

For each cohort, the Cumulative Default Rate (CDR) is calculated over one-year, two-year, and three-year time horizons to capture rating performance across varying periods. These default rates are then aggregated using an issuer-weighted average to determine long-term CDRs for each rating category.

As credit ratings are designed to reflect the likelihood of default, higher-rated categories are expected to demonstrate lower cumulative default rates, thereby confirming the ratings’ predictive validity with respect to credit risk.

Default Study:

Corporate:

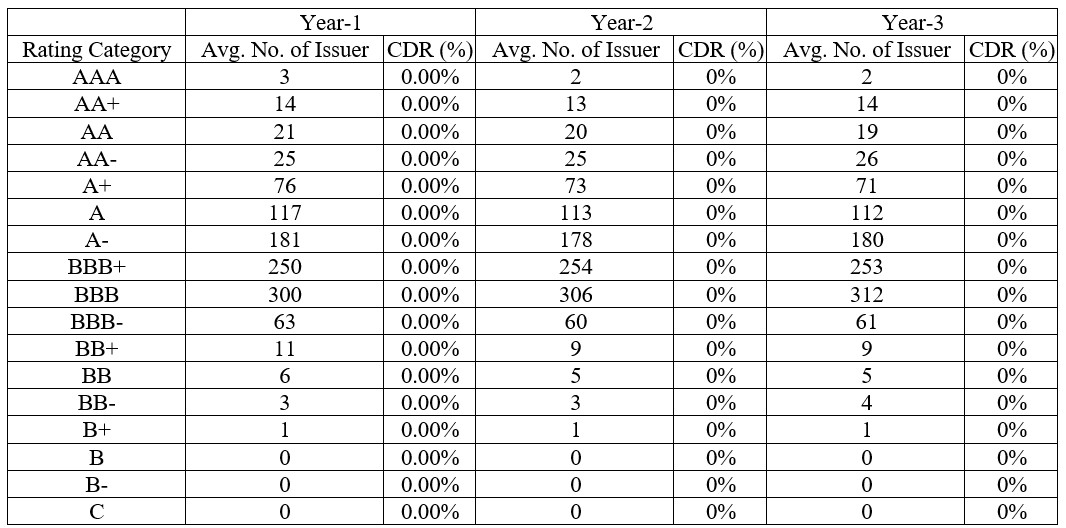

NCR has conducted default study for the clients rated during the period from the year 2018 to year 2023. Default study is carried out to see whether any issuer has defaulted i.e. has gone down to the level of ‘D’ category. While conducting the default study, NCR has used cohort method to calculate the performance of entities rated across various rating categories. Cumulative Default Rate (CDR) is calculated for each cohort within the period of study. The CDR is calculated over one-year, two-years and three-year’ time horizons to evaluate the performance of ratings over varying periods. Then, the issuer’s weighted average for one-year, two-years and three-years CDR is computed to arrive at long term CDR for each category. As rating is a measure of probability of default, a higher rating given to an entity implies a lower credit risk.

The categories are AAA,AA+,AA,AA-,A+,A, A-, BBB+, BBB, BBB-, BB+, BB, BB-, B+, B, B- and C. From the above table it can be stated that NCR has experienced no CDR over one-year, two-year and three-year basis.

SME:

NCR has also conducted default study for the clients rated during the period from the year 2018 to year 2023. Default study is carried out to see whether any issuer has defaulted i.e. has gone down to the level of ‘NSME-7’category. While conducting the default study, NCR has used cohort method to calculate the performance of entities rated across various rating categories. Cumulative Default Rate (CDR) is calculated for each cohort within the period of study. The CDR is calculated over one-year, two-years and three-years time horizons to evaluate the performance of ratings over varying periods. Then, the issuer’s weighted average for one-year, two-years and three-years CDR is computed to arrive at long term CDR for each category. As rating is a measure of probability of default, a higher rating given to an entity implies a lower credit risk.

The categories are NSME-1, NSME-2, NSME-3, NSME-4, NSME-5, NSME-6, and NSME-7. From the above table it can be stated that NCR has experienced no CDR over one-year, two-year and three-year basis.

|

Disclaimer: The Methodology is developed by National Credit Ratings Limited (NCRL) based on data/information from secondary reliable sources which is in compliance with the guidelines provided by Bangladesh Securities and Exchange Commission and Bangladesh Bank. NCRL puts best efforts to prepare this document. The methodology may inherit human error, technical and/or systematic error as its limitation. Therefore, NCRL does not provide warranty of any kind for this document. This is the property of NCRL and is only used for rating of corporate issues. None of the information in this document can be copied or otherwise reproduced, stored or disseminated in whole or in part in any form or by any means whatsoever by any person without written consent of NCRL. |

For further details please contact:

National Credit Ratings Ltd.

Zaman Tower (8th Floor)

37/2, Box Culvert Road, Purana Paltan

Dhaka-1000

Tel: +88-02-47120156-58

e-mail: ncrlbd10@yahoo.com, info@ncrbd.com

website: www.ncrbd.com