General Insurance Rating Methodology

1.0 Overview and Scope

Insurer Financial Strength (IFS) rating of a General Insurance Company assesses the financial strength of an insurance company and its capacity to meet obligations to policyholders on a timely basis. The financial strength rating is assigned to the company itself, and no liabilities or obligations of the insurer are specifically rated unless otherwise stated. The financial strength rating does not address the willingness of management to honor company obligations, nor does the rating address the quality of a company's claims handling services. In the context of the financial strength rating, the timeliness of payments is considered relative to both contracts and/or policy terms and also recognizes the possibility of acceptable delays caused by circumstances unique to the insurance industry, including claims reviews, fraud investigations and coverage disputes.

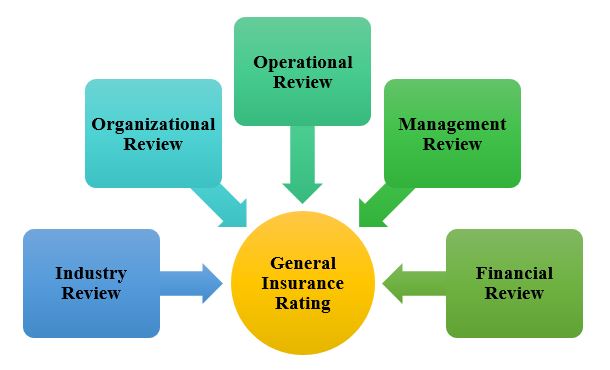

2.0 Framework

NCR's analyses incorporate an evaluation of the rated company's current financial position as well as an assessment of how the financial position may change in the future. Our ratings methodology includes an assessment of both quantitative and qualitative factors based on in-depth discussions with senior management. The evaluation of financial strength and credit quality focuses on the ability of the company to meet all of its obligations. NCR's rating methodology focuses on the following five areas of analysis:

2.1 Organizational Review

NCR places importance on the following factors:

- Ownership Structure

- Influence of the owners on the company and the extent of financial support they would extend in case of any emergency

- Diversification of products and services

- Corporate Governance

- Credibility of the BoD

- Internal Control System

- Market reputation

- Qualification & Experience of the owners in the relevant field

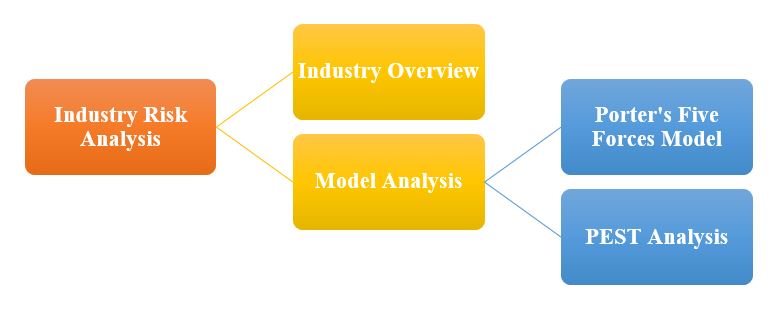

2.2 Industry Review

NCR places importance on different types of socio-economic variables while assessing industry risk analysis.

Some of the key factors, NCR takes into the consideration, are depicted below:

- Understanding of the industry in which the insurer operates.

- Judge the extent industry dynamics can impact the ratings levels that individual insurers operating in a given industry segment can achieve

- Uses its industry analysis to allow it to make better judgments on the unique attributes of individual insurers by being able to understand them on a relative as well as absolute basis.

- Regulatory, legal and accounting environment and framework.

- The potential "tail" of losses and ability to make accurate pricing decisions, as well as exposure to large unexpected losses

- The basis for competitive advantage in the sector.

NCR's specific evaluation of the general insurance industry focuses specially on Porter’s Five Forces Model. The components of the Model are as below:

- Threat of new entry

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of substitute

- Industry rivalry

2.3 Operational Review

NCR's operational review focuses on a given company's unique competitive strengths and weaknesses, operating strategies, and business mix. NCR's analysis focuses on both the historical and current business position and how it is expected to change over time. NCR's operational review includes an evaluation of:

- Underwriting expertise and market knowledge

- Process for approval to settle the claim

- Information Technology

- Distribution capabilities and mix

- Classes of business and changes in mix

- Market share and growth

- Brand name recognition and franchise value

- Expense efficiencies and operational scale

- Product and geographical mix

- Administrative and technological capabilities

2.4 Management Review

One of the most difficult, yet critical aspects of NCR's rating process is the level of confidence we develop in the management team and its stated strategies. Our specific evaluation of management focuses on the following:

- Strategic vision

- Appetite for risk

- Credibility and track record for meeting expectations

- Controls and risk management capabilities

- Accomplishments of key executives

- Number and frequency of management meeting

- Education of the management executive

- Experience of the Management executive in the related line of business

2.5 Financial Review

NCR's financial review includes the calculation of numerous financial ratios and other quantitative measurements. These are evaluated based on industry norms, specific rating benchmarks, prior time periods and expectations developed by NCR specific to the rated entity. Though the financial review is largely a quantitative exercise, the interpretation of the results and weighing them into the final rating includes significant elements of subjectivity and qualitative judgment.

In addition to the published financial statements NCR examines the management reports, evaluations and company projections. The financial review is broken into seven main segments:

2.5.1 Underwriting Quality

- Underwriting expertise in each class of business

- Pricing credibility

- Pricing flexibility given competitive and regulatory environment

- Exposure to large losses

- Balance of premium growth and underwriting discipline

- Controls over any third-party underwriters, such as managing general agents

- Claims management and expertise

- Expense efficiencies, and impact of ceding commissions on expense ratios

- Measuring underwriting performance using two common ratios - the loss ratio and the expense ratio.

- Combined Ratio (A combined ratio below 100% translates into an underwriting profit, and above 100% represents an underwriting loss)

- Growth in premiums and revenues

2.5.2 Profitability Strength and Stability

- Sources of profits: Underwriting and Investment income (interest, dividends and capital gains and can vary as to their taxable nature)

- The level of profits on both and absolute and relative basis,

- Investment yield

- Return on Assets (ROA) and Return on Equity (ROE)

- Potential variability in profitability

- Stability and growth pattern, on Year-on-Year basis, of the underwriting profits and other supporting sources of income

2.5.3 Reinsurance Coverage and Utilization

In assessing an insurer's use of reinsurance, NCR's goal is to determine if capital is adequately protected from large loss exposures, and to judge if the ceding company's overall operating risks have been reduced or heightened. In the traditional sense, reinsurance is used as a defensive tool to lay off risks that the ceding company does not want to expose to its earnings or capital. When reinsurance is used defensively, NCR's goal is to gain comfort that:

- Sufficient amounts and types of reinsurance are being purchased to limit net loss exposures given the unique characteristics of the book

- Reinsurance is available when needed

- The cost of purchasing reinsurance does not excessively drive down the ceding company's profitability to inadequate levels, and weaken its competitive pricing posture

- The financial strength of reinsurers is strong, limiting the risk of uncollectible balances due to insolvency of the reinsurer.

- Exposure to possible collection disputes with troubled or healthy reinsurers is not excessive

In cases of aggressively used Reinsurance, NCR examines why the reinsurance approach is being used, and stresses what would happen if the programmed developed adversely. Examples of aggressive use of reinsurance include excessive cessions under quota share treaties simply to earn ceding commissions, and use of finite or other financial reinsurance that "smooth results" rather than transfer risk as the core part of the reinsurance program.

2.5.4 Claim Settlement

NCR's analysis also focuses on the following factors:

- No. of Claim Lodged

- Total Claim Lodged

- Claim Settled

- Total Claim paid during the year

- Total Claim Outstanding

2.5.5 Asset Quality

- Company's investment guidelines and management controls

- Credit risk by looking at the company's exposure to higher risk investments relative to the total investment portfolio and capital base

- Investments Portfolio diversification by major asset class and industry sector is also evaluated to identify any concentration issues

- Market risk is evaluated to identify potential changes in asset valuation due to a change in market conditions and the interest rate environment.

- Historical investment performance is evaluated to determine how well the company's investment strategies are executed.

- Level of non-performing investments

- Investment Income

- Investment yield

- Total return

- Duration and maturity structure

- Volatility of investment valuations is considered in the context of both book value and underlying market (liquidation) values.

2.5.6 Liquidity

In short-tail insurance sectors, liquidity is particularly important. NCR judges liquidity based on the marketability of the investments. The manner in which the company values its assets on the balance sheet is also closely examined. NCR considers the following factor in assessing liquidity.

- Liquid assets

- Liquid assets to Current Liabilities

- Trends in operating and underwriting cash flows

- Off balance sheet sources of liquidity, including committed and uncommitted lines of credit, asset securitization and other funding arrangements

- Liquid assets/NPR (times)

- Liquid assets/Net Claims Expense (times)

- Claims outstanding days (provision for outstanding claims/ claims expense * 365)

- Current ratio (Insurance Related Assets/Insurance Related Liabilities)

- Total Investment/Total Assets

2.5.7 Solvency and Capital Adequacy

Reserve adequacy is a critical part of the financial review, and a demonstrated ability to maintain an adequate reserve position is a crucial characteristic for a highly rated insurer. While the analysis of reserve adequacy includes a robust quantitative element, much of NCR's reserve review is qualitative in nature. Accordingly, our review focuses on the following:

- Historical track record in establishing adequate reserves

- Management's reserving targets

- Key reserving assumptions

- General market and competitive pricing environment, and propensity of management to carry weaker reserves during down cycles

- Use of discounting, financial reinsurance or accounting techniques that reduce carried reserves

- Comparison of company loss development trends relative to industry and peers

- Solvency Ratio:

- Premium Solvency Ratio [Equity/NPW] times

- Reserves Solvency Ratio [Net Provision for Outstanding Claims/Equity]

- NPR/ Equity

- NPR/ Financial Base

- Net Claims/ Equity

- Net Claims/ Financial Base

- Adjusted Liquid Assets + Strategic Assets at Market Value)/NPR

- Underwriting Profit/ Financial Base

- Future capital needs based on business growth and other factors

- Financial flexibility, or the company's ability to access internal and external capital sources,

|

Disclaimer: The Methodology is developed by National Credit Ratings Limited (NCRL) based on data/information from secondary reliable sources which is in compliance with the guidelines provided by Bangladesh Securities and Exchange Commission and Bangladesh Bank. NCRL puts best efforts to prepare this document. The methodology may inherit human error, technical and/or systematic error as its limitation. Therefore, NCRL does not provide warranty of any kind for this document. This is the property of NCRL and is only used for rating of corporate issues. None of the information in this document can be copied or otherwise reproduced, stored or disseminated in whole or in part in any form or by any means whatsoever by any person without written consent of NCRL. |

For further details please contact:

National Credit Ratings Ltd.

Zaman Tower (8th Floor)

37/2, Box Culvert Road, Purana Paltan

Dhaka-1000

Tel: +88-02-47120156-58

e-mail: ncrlbd10@yahoo.com, info@ncrbd.com

website: www.ncrbd.com