Corporate Rating Methodology

1.0 OVERVIEW AND SCOPE

This article represents National Credit Ratings’ (NCR) Corporate Rating Methodology. NCR provides corporate rating to businesses that fall under the definition of “Large Industry” as per the definition of the National Industrial Policy 2022 of the Government of the Peoples Republic of Bangladesh. NCR also takes into account the loan limit approved (greater than the maximum loan limit of CMSMEs) by the banks and financial institutions and the division under which the facility or facilities is/are sanctioned. However, depending on distinctive features of underlying businesses (bank, insurance etc.), NCR has developed separate methodologies for those businesses. In such cases, those methodologies take precedent over this methodology.

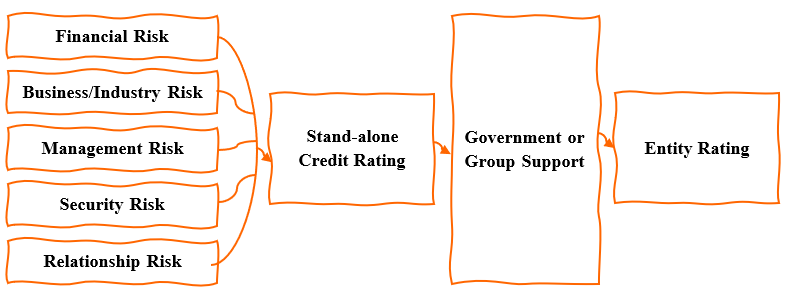

2.0 FRAMEWORK

For corporate ratings assessment, NCRL mainly analyze five risk segments, viz. Financial Risk, Business and Industry Risk, Management Risk, Security Risk and Relationship Risk. In addition to these considerations, an entity’s credit rating may also be influenced by its ownership pattern, the nature of linkages with its parent or group entities, the corporate legal structure, degree of financial flexibility, track record of operations and debt servicing and vulnerability (if any) to discrete event risks.

2.1 FINANCIAL RISK ANALYSIS

Analysis of financial risk involves evaluation of past and expected future financial performance of the entity with emphasis on assessment of adequacy of cash flow to meet financial obligations.

2.1.1 Earnings and Cash Flow:

Key elements in determining overall financial health of an entity are earnings and cash flow, which affect the maintenance of operating facilities, internal growth and expansion, access to capital and the ability to withstand downturns in the business environment. The availability of funds to repay debt without external funding is given special consideration. The cash flow from operations provides a company with more secure credit protection than dependence on external sources. NCR analyses cash flow from core as well as non-core operations, the stability of cash flow and its adequacy to meet debt servicing requirements.

2.1.2 Capital Structure and Leverage:

2.1.3 NCRL analyzes capital structures to determine entity’s reliance on external financing. To assess the credit implications of leverage of a unit, several factors are considered including nature of its business environment and the principal fund flows from operations.

2.1.4 Liquidity and Financial Flexibility:

Analysis of liquidity helps to understand the company’s ability to meet its short-term obligations. Financial flexibility refers to alternative sources of liquidity available to the unit as and when required. Entity’s contingency plans under various stress scenarios are considered and examined. Access to alternate sources of funds at the time of crunch is reviewed. Other factors that contribute to financial flexibility such as the ability to re-deploy assets and revise plans for capital spending are also analyzed.

2.1.5 Profitability:

NCRL puts due weight to profitability indicators, like Earnings (profit) before Interest, Tax, Depreciation & Amortization (EBITDA), Profit Margins, Return on Equity (ROE), Return on Assets (ROA), Return on investment (ROI) etc.

2.1.6 Coverage Position:

Coverage position is important for assessing a company's financial health and managing risks. It shades light on the solvency and creditworthiness of an entity. The interest coverage ratio gauges a company's capacity to meet interest obligations, serving as a measure of solvency, creditworthiness, and informing investor decisions. On the other hand, the debt coverage ratio evaluates a company's ability to cover both interest and principal payments, providing a broader perspective on debt repayment capability and long-term financial stability. These ratios are crucial for strategic planning, influencing decisions on additional debt, and instilling confidence in lenders. Regular monitoring of these ratios helps identify financial risks and supports proactive measures to ensure a company's sustained viability and mitigate potential difficulties in meeting debt obligations.

2.1.7 Financial Management:

NCRL rating analysis places due weight to the quality of financial management. Managing finance through budgetary control system, working capital management through budgetary control system, management of cost efficiency through installation of appropriate cost accounting system, product costing, use of accounting information by the management, IT base financial management system, etc. all are taken into consideration while ascertaining the extent of financial management

2.2 INDUSTRY RISK ANALYSIS

NCRL measures the industry risk by the strength of the industry within the economy. The analysis of industry risk focuses on the prospects of the industry and the competitive factors affecting the industry. The industry environment is assessed to determine the degree of operating risk faced by the entity in a given business, investment plan of the major players in the industry, demand supply factors, price trends, changes in technology, international/domestic competitive factors in the industry, entry barriers, capital intensity, business cycles etc. are key ingredients of industry risk. NCRL also takes into account the strategic nature of the industry in the prevailing policy environment, role of regulation and legislation.

2.2.1 Operating Environment:

NCRL assesses an entity’s rating by considering the industry fundamentals which includes market competition (domestic & international), seasonality & cyclicality, market structures (i.e., monopoly, oligopoly, & duopoly), capital intensity, predictable demand levels and other inherent risks.

2.2.2 Regulatory Policy:

Regulatory framework has direct impact on the industry and to the entity operating under the industry. The factors are government’s industrial policy, annual budgetary, incentives (both fiscal & non-fiscal) provided by the government, labor law, environmental compliance, Export /Import Policy, as well as the policies provided by the international bodies.

2.2.3 Industry Growth:

NCRL considers industry life cycle such as introductory stage, growth stage, maturity stage and sunset stage, all deserves weightage in analysis.

2.2.4 Entry/Exit Barrier:

NCRL considers the prohibition factors such as huge capital outlay, creation of franchise value and brand image of the products needing time, government restriction, distribution network etc.

2.2.5 Vulnerability:

The vulnerability of the industry depends on controllable and uncontrollable factors which are sensitivity of demand, change in various policies, price volatility of raw materials, political influence.

2.3 BUSINESS RISK ANALYSIS

Analysis of business risk involves evaluation of entity’s historical performances with emphasis on assessment of adequacy of cash flow to meet its’ operating expenses. NCRL measures business model, business strategies and competitive strength in the industry. There is huge number of sub sectors in the manufacturing sector. NCRL consider the entity’s competitive position within the industry by analyzing the historical performances and competitive edges & advantages. Some of the key parameters used for assessing business risk are:

2.3.1 Size of Business, Market Share & Competitive Position:

Small size entity has limited access to funds leading to lack of financial flexibility resulting in lower protection of margins during economic downturn. Large firms, on the other hand, have ability to sustain, even during adverse situation. Hence, size of the business is an important indicator in identifying the strength of an entity. The entity’s current market share in its major activities and the historical protection of its position and projected ability for the future are important indicators of the competitive strengths of the entity.

2.3.2 Age of Business:

The age of a business is a critical factor that holds implications for its credibility, stability, and market standing. Established businesses often garner greater trust from customers, investors, and partners due to a track record of success, longevity, and a proven ability to navigate market challenges. The age of a business can signal financial resilience, experience, and the establishment of a loyal customer base. For investors, a mature business may signify a lower level of risk compared to a newly established venture. Additionally, the age of a business can influence its access to credit and partnerships, as longer-standing enterprises are often viewed as more reliable and capable of fulfilling their commitments. Overall, the age of a business contributes significantly to its reputation and can be a key factor in determining its competitiveness and attractiveness within the marketplace.

2.3.3 Business Outlook

A business outlook forecasts the future prospects and conditions of the business. A positive business outlook suggests optimism about growth opportunities, profitability, and overall success, while a negative outlook may indicate concerns about challenges, economic downturns, or other adverse factors.

2.3.4 Diversification:

Since diversification results in better sustainability in operating result of a unit, NCRL analyzes the sustainability aspect with due weight. Cost leadership & product differentiation brings sustainability.

2.3.5 Location:

Plant location highly impacts a manufacturing company. Location that has all the utilities facilities and good transportation and communication system is an added advantage.

2.3.6 Marketing & Distribution Agreement:

Depending on the nature of the product, NCRL analyzes the depth and importance of the marketing and distribution capabilities of entities through trusted customer base and customer relationship and geographical coverage.

2.3.7 Exchange Rate Risk:

Foreign exchange rate risk most often affects businesses, engaged in exporting and importing products & service.

2.4 MANAGEMENT RISK:

Effectively managing management risk is crucial for the overall success and sustainability of an organization. It involves aligning decisions with strategic objectives to reduce the likelihood of operational inefficiencies, financial crises, and reputational damage. Proactive management of compliance and regulatory risks ensures legal adherence, fostering a positive organizational culture that boosts employee morale and productivity. Transparent risk management practices instill confidence in investors and stakeholders, protecting the brand and enhancing the organization's credibility.

2.4.1 Experience:

The experience of a management team is paramount as it brings a wealth of knowledge and seasoned judgment to guide the strategic direction of a company. A management team with extensive industry experience understands market dynamics, anticipates challenges, and identifies opportunities more effectively. Their collective expertise enables informed decision-making, mitigates risks, and enhances operational efficiency. Experienced leaders often have a track record of navigating diverse business scenarios, fostering adaptability and resilience. Additionally, their credibility instills confidence in investors, stakeholders, and employees, contributing to a stable and trustworthy organizational culture. In essence, the importance of an experienced management team lies in its ability to provide strategic vision, navigate complexities, and steer the company toward sustained success in a competitive business landscape.

2.4.2 Corporate Governance:

The assessment of corporate governance involves analysis of the governance data and information and review of an entity’s governance practices. The independence and effectiveness of the board of directors are considered to be an essential element of a robust corporate governance framework. The board’s oversight of the audit function is assessed; being an important safeguard in protecting the integrity of an entity’s financial reporting. Business plan, mission, policies and future strategies of the entity in relation to the general industry scenario are also assessed.

2.4.3 Management Evaluation:

Management evaluation includes Management planning and ability to clarify the plan to others, quality of management business plan, Track record of management in executing previous business plan, degree of operational and financial flexibility, management performance evaluation through economic cycle as well as technological, supply-demand and other cycle.

2.4.4 System& Control:

Adequacy of the internal control systems compared to the size of business is closely examined. Existence of proper accounting records and control systems adds credence to the accounting figures. Management information system commensurate with the size and nature of business enables the management to stay tuned to the current business environment.

2.4.5 Organizational Structure:

NCRL closely observes organizational structure for assessment of an entity which differ according to size or nature of business.

2.4.6 Performance of the Group Companies:

Interests and capabilities of the group companies belonging to the same management give important insights into the management capabilities and performance in general.

2.5 OPERATIONAL RISK:

2.5.1 Raw Materials Risk:

Availability of raw materials either from local market or abroad market plays an important role in the rating process. In case of local supply, the supply chain, sufficiency in terms of quality, numbers of suppliers, seasonality, price fluctuation, lead time and in case of import, additional factors such as import policy, the government duty structure, import restrictions all plays important role in NCRL’s analytical process.

2.5.2 Technology:

Modern technology provides competitive edge over old technology. Asset composition, balanced equipment for maximum production efficiency all play positive roles while old and outdated technology reduces competitiveness having a negative impact on rating.

2.5.3 Cost Structure:

The cost factors and efficiency parameters of existing operations are assessed with respect to expenditure levels required to maintain its existing operating efficiencies as well as to improve its efficiency parameters in a competitive scenario. Nature of technology may also influence the cost structure.

2.5.4 Credit & Inventory Management:

Credit control policies and its effectiveness play an important role in the liquidity management of the manufacturing unit. It is important for manufacturing unit to maintain optimum level of inventory.

2.5.5 Compliance Issue:

NCRL reviews the extent of compliance to the local environmental rules, regulators clearance, updated tax and other clearance, compliance with the labor related rules such as minimum wage payments, excess hour rules, compliance of the buyer’s requirements etc.

2.6 SECURITY RISK:

NCR considers quality of security, adequacy in value of the primary security such as Pledge, LIM, FDR, etc. and collateral security and others additional collateral such as personal guarantee, insurance coverage and legal risk of the collateral. Subordination status of the collateral security is also considered commensurately.

2.7 RELATIONSHIP RISK ANALYSIS:

NCR evaluates willingness of entity to repay the obligation from its past track record of loan repayment besides the evaluation of ability to repay the loan obligation. Length of relationship with bank and financial institutions, nature of facility availed, timeliness of loan repayment, cheque dishonor record, rescheduling & default history of the corporate provide a view of client-bank relationship.

2.8 PROJECT RISK EVALUATION:

To ascertain project risks, NCRL endeavors to understand the entity’s rationale for undertaking the new investments. The risk profile could be different depending on whether the new project is a case of related diversification or an unrelated diversification. The other factors that are assessed include: (i) track record of the management in project implementation; (ii) experience and quality of the project implementation team; (iii) experience and track record of the technology supplier; (iv) extent to which the capital cost is competitive; (v) financing arrangements in place; (vi) raw material linkages; (vii) demand outlook; (viii) competitive environment; and (ix) marketing arrangement and plans.

2.9 KEY RATIOS

Financial ratios are used to make an assessment on the financial performance of the entity and see its relative performance with respect to its peer group within the industry.

2.9.1 Growth Rate:

Trends in the growth rates of the company vis-à-vis the industry reflect the ability of the entity to sustain its market share, profitability and operating efficiency. The focus is drawn on growth in revenue, EBIT and NPAT.

2.9.2 Coverage and Leverage Ratios:

Coverage ratios show the relationship between debt servicing commitments and cash flow sources available for meeting those obligations. Leverage refers to the percentage of debt finance relative to an entity’s total capital. Leverage ratios help in assessing the risk arising from the use of debt finance. Net debt to EBITDA provides perspective on an entity’s borrowing capacity and ability to meet debt obligations fallen due. Debt to Equity ratio or Gearing shows total or net debt as percentage of shareholders equity which can be used as an indicator of the flexibility to raise new debt.

2.9.3 Turnover Ratios:

Turnover ratios also referred to as activity ratios or asset management ratios, measure how efficiently the assets are employed by the entity. These ratios are based on the relationship between the level of activity, represented by sales, CGS and the level of various assets including inventories and fixed assets.

2.9.4 Liquidity Ratios:

Liquidity ratios such as current ratio and quick ratio are broad indicators of the liquidity position of a unit. Liquidity ratios are important parameters for rating short term debt. Cash flow statements are also important indicators of liquidity.

2.9.5 Profitability Ratios:

Profitability reflects the final operational result of an entity. The ability of an entity to earn profit determines the protection available to it. Gross Margin, Operating Margin and Net Profit Margin are important measures of profitability and are quite helpful in assessing relative profitability of entity within the same industry. Return on Equity measures the annual return on equity. Since ROE is dependent on capital structure the unit, the use of leverage can increase this ratio, assuming sufficient funds are available to service the debt.

|

Disclaimer: The Methodology is developed by National Credit Ratings Limited (NCRL) based on data/information from secondary reliable sources which is in compliance with the guidelines provided by Bangladesh Securities and Exchange Commission and Bangladesh Bank. NCRL puts best efforts to prepare this document. The methodology may inherit human error, technical and/or systematic error as its limitation. Therefore, NCRL does not provide warranty of any kind for this document. This is the property of NCRL and is only used for rating of corporate issues. None of the information in this document can be copied or otherwise reproduced, stored or disseminated in whole or in part in any form or by any means whatsoever by any person without written consent of NCRL. |

For further details please contact:

National Credit Ratings Ltd.

Zaman Tower (8th Floor)

37/2, Box Culvert Road, Purana Paltan

Dhaka-1000

Tel: +88-02-47120156-58

e-mail: ncrlbd10@yahoo.com

website: www.ncrbd.com